We may not see ourselves as racist, but as business leaders we may be inadvertently contributing to systemic racism.

By Cheryl Stallworth, cofounder at ShedLight.org. Cheryl is an experienced corporate executive and a social impact and brand purpose thought leader.

Our recent national focus has been on eliminating police shootings. This is obviously crucial to demonstrating that we are a country that no longer sanctions the killing of people for minor legal infractions, and that Black lives really do matter. ShedLight’s research reveals that most people focus on overt racism (and no one we’ve talked with considers themselves a “racist,” by the way). But in matters of race, there are many shades of gray: from stereotyping and implicit bias, to the systemic or structural racism that is the root cause of social and economic problems plaguing Black communities. This is well-documented in economic research. Corporations have tremendous political and economic influence. And it is our collective responsibility to use this power to formulate social impact strategies that reduce systemic racism.

The Myth of Meritocracy: A leadership imperative

The American Dream is built on meritocracy, “If you work hard, you can make it.” This ideal makes it convenient for politicians, policy influencers, and business leaders to deny the existence of systemic racism. But, the reality is that hard work alone does not necessarily result in upward economic mobility or long-term wealth creation. Until we acknowledge this fact we cannot create a better future for all Americans. Check out this excerpt from Michael Sandals Book, The Tyranny of Merit, which eloquently topples the myth of the meritocracy. Our research also reveals that there is no perceived meritocracy among people who work every day and cannot make ends meet. And for Black Americans, structural racism only intensifies the problem. Also, economic struggles have a profound emotional cost. For a deeper perspective in the voices of everyday people, check out our American Stories video essays. Middle Class Dreams, Working Poor Reality and Of Many, One: Why Doesn’t America Love Us Back?

How does Systemic Racism Impede the Creation of Generational Wealth?

Your Black and Latino employees are not beginning their careers with the same advantages as your White employees. In Examining the Black and White Wealth Gap the Brookings Institute cites numerous historic examples of Black American attempts to create real wealth. But practices such as redlining, biased implementation of the GI Bill, employment discrimination, and Jim Crow laws have created a permanent Black economic underclass.

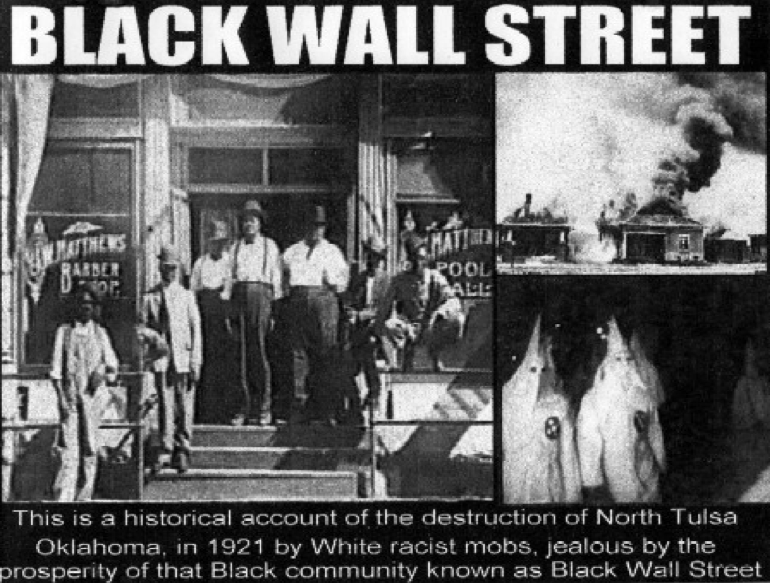

The Brookings Institute also found that in 2020, Americans inherited $765 billion in untaxed income. This represented 4% of household earnings. What’s more, inheritances are often used for additional wealth-generating investments such as real estate and college tuition. But for Black Americans the dream of wealth creation has been deferred, to quote Langston Hughes. The problem is so endemic that attempts to create wealth have even been met with bloodshed. The destruction of Tulsa, Oklahoma’s Greenwood District is a tragic reminder of how Black Americans were massacred for achieving the American Dream.

According to the Washington-based Economic Policy Institute, a think tank with expertise on issues facing low and middle-income Americans, the economic fortunes of Black and Latino Americans are not improving. White middle-income households (earning between $37,201 and $61,328 per year) own an average of $86,100 in assets. Assets average $11,000 for Black families and $8,600 for Latino families in the same income range.

Moreover, this gap in wealth creation is growing. According to Calvin Schermerhorn’s article in the Washington Post, Why the Racial Wealth Gap Persists, More than 150 Years after Emancipation, “Unless current economics change, black families will be poorer on the 175th anniversary of Emancipation than they were in 1980.” This is without considering the devastating financial impact of the Covid-19 Pandemic.

Why Focus on Corporate Governance and the Capital Markets?

Business leaders have told us that now more than ever, corporations have a vital role to play in creating wealth for Black communities. And, in reducing the negative impact of systemic racism on American economic advancement, as a whole. Creating a financial system that drives economic justice would enable under-represented people of all races, to create generational wealth–including White working-class people.

As we’ve seen throughout history, income-generating investment assets (for example, equities and real estate) have been the key to financial freedom for higher earning White Americans. We’ve all heard the expression, “Let your money work for you.” Stock ownership is where true accountability resides in Corporate America. Those who are not able to take part in this financial ecosystem cannot gain real power in a capitalistic society. Correcting systemic financial inequities would help close the unsustainable wealth gap in America. It also would make it possible for all Americans to get a fairer shot at achieving the American Dream.

At ShedLight.org we believe, as a nation, America cannot allow people to work every day while not having the means to create a strong financial foundation for future generations.

Taking Action Among Employees: How Can We Give More Power to the People?

1. Listen to the voices of workers and give them a stronger voice in corporate governance.

Miguel Padro, Senior Program Manager for the Aspen Institute Business and Society Program, shares great ideas in his unflinchingly honest blog post, America’s Corporate Governance System is Racist Too. White households headed by college graduates own 78% of all corporate stock in America, while households headed by Black and Latino college graduates own less than 3%. So even higher income people of color are not benefitting from the significant economic traction that stock ownership affords. Furthermore, they are not gaining access to the power investors exercise through the voting process that gives them a say in corporate governance. Mr. Padro’s piece raises a provocative question, “What would corporate governance look like if we truly tried to address racism and enabled greater participation of under-represented workers?” He goes on to say, “Corporate governance may not commit physical violence against people of color, but the very design of corporate governance eliminates their voices and causes real harm.”

2. Focus on Stakeholder Value versus Shareholder Value.

In our recent discussion with Miguel Padro and Judy Samuelson, Founder and Executive Director of Aspen Institute’s Business and Society Program, both emphasized the importance of workers, or “stakeholders”, in delivering a great customer experience. Companies are not democracies. But an opportunity exists to make companies stronger by giving workers a voice in crafting the corporation’s purpose, and a say in corporate governance through board participation. This shift in focus from shareholder value to stakeholder value will only make the companies and the communities they serve more relevant. It also will give employees an opportunity to contribute to and share in the company’s prosperity in a meaningful way. Achieving this will require that we forge change by reimagining corporate rewards, incentives, and compensation.

3. Remember, Your Daily Decisions Matter!

Judy Samuelson reminds us that we are all part of the problem because we make conscious decisions as consumers and investors. We focus on price, convenience, and ROI versus the things we say we care about.

ShedLight’s view is that as citizens, customers, business leaders, investors, and employees, we must make corporations more accountable for correcting the wealth imbalance by making our voices heard. We are proving our ability gain ground on social justice. We now need to translate this power to the fight for economic justice.

Recommended Reading: For historical perspective…

Caste: The Origins of our Discontents by Isabel Wilkerson

The Color of Money: Black Banks and the Racial Wealth Gap by Mehrsa Baradaran

For additional insights on how we can take action…

Eliminating the Black-White Wealth Gap Is a Generational Challenge by Christian E. Weller and Lily Roberts

The Six New Rules of Business: Creating Value in a Changing World by Judy Samuelson

Reimagining Capitalism in a World on Fire by Rebecca Henderson

Cheryl Stallworth has been CEO of Firefly/Milward Brown (a Kantar company) and a senior executive at Colgate-Palmolive and The Coca-Cola Company.

Please connect with her on LinkedIn